For years, you have been selling and supporting advanced technology proven to help customers capture and convert collected data into profitable decisions. And the same opportunity exists for dealerships to capitalize on their own data.

But data doesn’t magically turn into dollars. Defining operational goals and understanding how to achieve them requires precise measurement and strategic management.

So how can your dealership transform data into decisions?

It’s a combination of the right key performance indicators (KPI), the right tools and asking the right questions, says Jim Henderson, MAC Advisor and Currie Management Consultant.

We’ve assembled Henderson’s best tips from our recent webinar on how an “analysis to action” approach with dealership data can increase customer satisfaction, streamline department efficiency and increase overall profitability.

Click to Jump Ahead:

How is Analytics to Action Done?

The last thing dealerships want to do is bury their leadership, general managers, service writers and technicians under an avalanche of data.

When it comes to analytics, Henderson says it’s easy to get overwhelmed by a dashboard of metrics if there’s no direction for how to interpret and apply them.

He offers these 3 steps to avoid paralysis by analysis.

1. Keep Your Eyes on the KPIs

Logistical bottlenecks can bog down employee performance and customer satisfaction. To keep service, sales and parts truly in sync, dealerships need to identify pain points in each department to solve them.

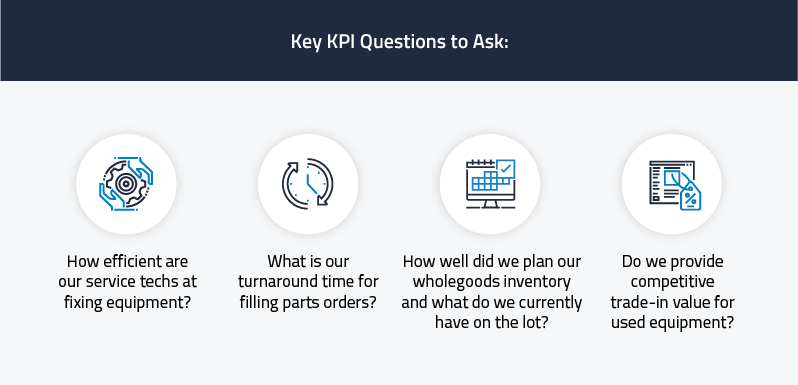

Dig deeper into KPIs by asking these questions:

- How efficient are our service techs at fixing equipment?

- What is our turnaround time for filling parts orders?

- How well did we plan our wholegoods inventory and what do we currently have on the lot?

- Do we provide competitive trade-in value for used equipment?

Answering quantifiable questions like the ones above will lay the foundation for a “high-performance culture.”

Building a progressively productive culture by benchmarking your KPIs is what separates the dealership that makes 10% operating profit and the one that makes 1-2%, Henderson says.

Watch Next: How to Unlock the Hidden Potential of Your Dealership’s Data

2. Measure What Matters

A common dilemma that dealerships face is deciding what metrics to measure before they can extract value. Add in the day-to-day responsibilities of the decision-makers in your dealership, and investing in analytics can become an afterthought.

However, developing the discipline to align dealership data objectives and IT goals is critical because the two intertwine throughout the sales, service, and parts department.

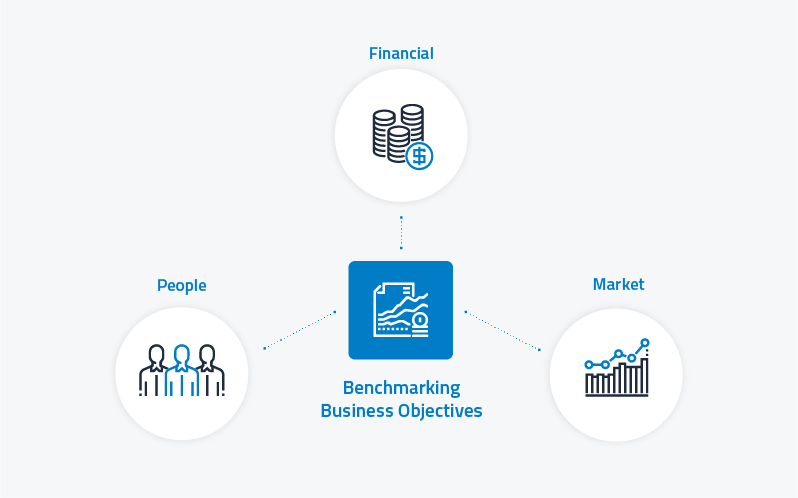

From a manager’s perspective, benchmarking business objectives can be broken down into 3 areas:

- Financial: Leveraging data to set and meet qualitative goals for rate of return on equipment, asset management and budgeting.

Critical question – How effectively are we managing assets (new, used, aging) and do we have benchmarks in place to execute against during an economic downturn?

- Market: Establishing a baseline, then expanding customer retention and loyalty data to grow market share.

Critical question – How are we quantifying customer satisfaction and what are we doing to improve it?

- People: Measuring employee performance to quantify dealership culture.

Critical question – What kind of comparative analysis are we doing across departments to reduce employee turnover or burnout and create a sustainable culture?

Decisive management of the areas above depends on how effectively a dealership measures them. Chances are, you already have defined profit goals for service.

How do you respond if those aren’t met? With the right tools, a data-driven review can uncover whether the problem stems from poor time management, inefficient billing or a more nuanced issue.

An effective analytics tool allows for “data drill downs” for a deeper understanding of how to bridge departmental gaps. This approach helped a dealership Henderson worked with uncover a service error in how it billed trucks and travel time.

Analysis of service data revealed that a segment of customers had only been charged a third of the dealership’s standard rate. While the oversight initially cost time and money, it ultimately helped the dealership transform a breakeven service department into a profitable one (hear more about the outcome at the 22-minute mark in our recent webinar).

3. Create an Actionable Plan

As the saying goes, ‘you don’t know what you don’t know.’ Putting dealership data to work creates the ability to not only solve, but also anticipate challenges. It could be correlating inventory levels with fill rate to manage turn ratio and avoid an excess of aged parts and equipment.

Or it might be proactive accounting with accounts receivable to keep dealership cashflow at appropriate levels. Henderson says it’s relatively rare for dealerships to develop a methodology for keeping cashflow tight, but establishing analytical benchmarks that prioritize overdue invoices provides a plan for collecting aged receivables.

If a dealership establishes a 30-60-day timeline to receive payment, having invoice information at your fingertips in an online dashboard could trigger a timely follow-up with customers who are at the 45-day mark. Communicating the timeline to customers also creates consistency and helps avoid uncomfortable conversations about past-due invoices.

Analytics can drive difficult, but informed business decisions. Remember the dealership that discovered an error in how it was billing for service trucks and travel?

It turned out that the dealership’s largest customers were the ones receiving the discounted rates. Does the dealership risk losing market share or sacrifice the time and cost by sending service techs out to satisfy their biggest customers?

After crunching the numbers, the dealership told its largest customers that retaining the talented techs they rely on for quality support requires fair compensation for comprehensive service.

The decision utilized all three steps in the analytics-to-action process:

- identifying key KPIs,

- measuring the most valuable aspects of the business with the right tools, and

- understanding how to interpret the data to implement a mutually beneficial plan for the dealership and its customers.

Conclusion

Leveraging your dealership’s data to improve deliverables isn’t an overnight process. But gaining traction with an advanced software solution creates recurring returns for you and your customers.

Contact our sales team to learn more about DIS Analytics here.

![Fixed Absorption: Your Dealership’s Recession Shield [Infographic]](https://www.discorp.com/wp-content/uploads/2025/04/Blog-prev-190x190.jpg)